Berikut merupakan analisa market secara keseluruhan.

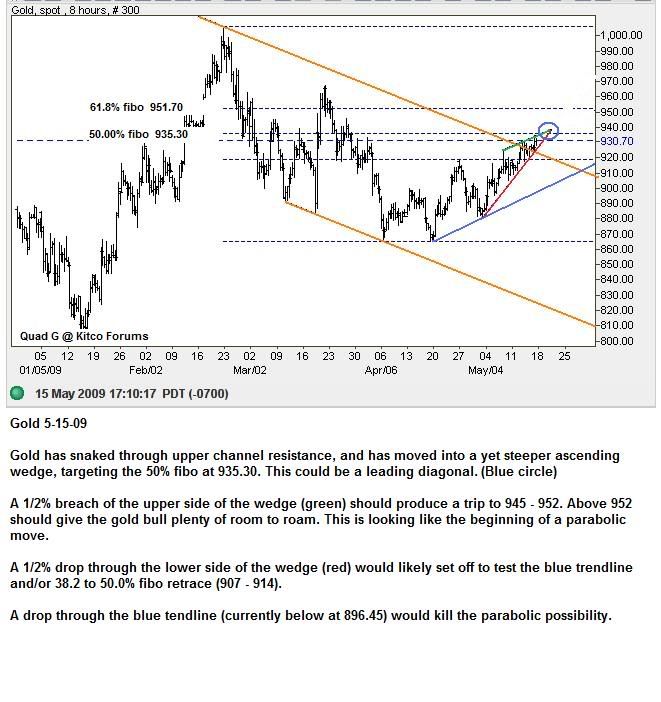

Perhatikan pada ST (SHORT TERM = A few day to few week) for gold target di mana price of gold can be up to 988-997 USD/oz.

Untuk memahami jadual yang saya post dibawah ini, sila perhatikan warna merah dan warna hijau. Jika ia bewarna merah, ia bermaksud, market berada di dalam down trend. Dan sekiranya ia berwarna hijau bermaksud market berada di dalam up trend.

Sebagai contoh:

Sila lihat pada row gold. Pada short term column, terdapat bearish dan bullish. Dan warna hijau berada pada 970 (bullish). Di sini ia bermaksud, sekiranya, price masih berada pada atas paras 970 ia akan bullish trend dan sekiranya price berada pada paras 964.65 USD/oz dan kebawah, menunjukan market berada di dalam keadaan bearish.

So secara conclusi nya:

Pada SHORT TERM (BULLISH) if price still above 970

pada MID TERM (BULLISH) if price still above 941.15

Pada LONG TERM (BULLISH) if price still above 750.00